tax sheltered annuity vs 401k

Tax sheltered annuity. A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt.

Annuity Vs 401k Annuity Vs 401k Explained Youtube

One good way to grasp the difference between a 401 k and annuity is to understand how people use them.

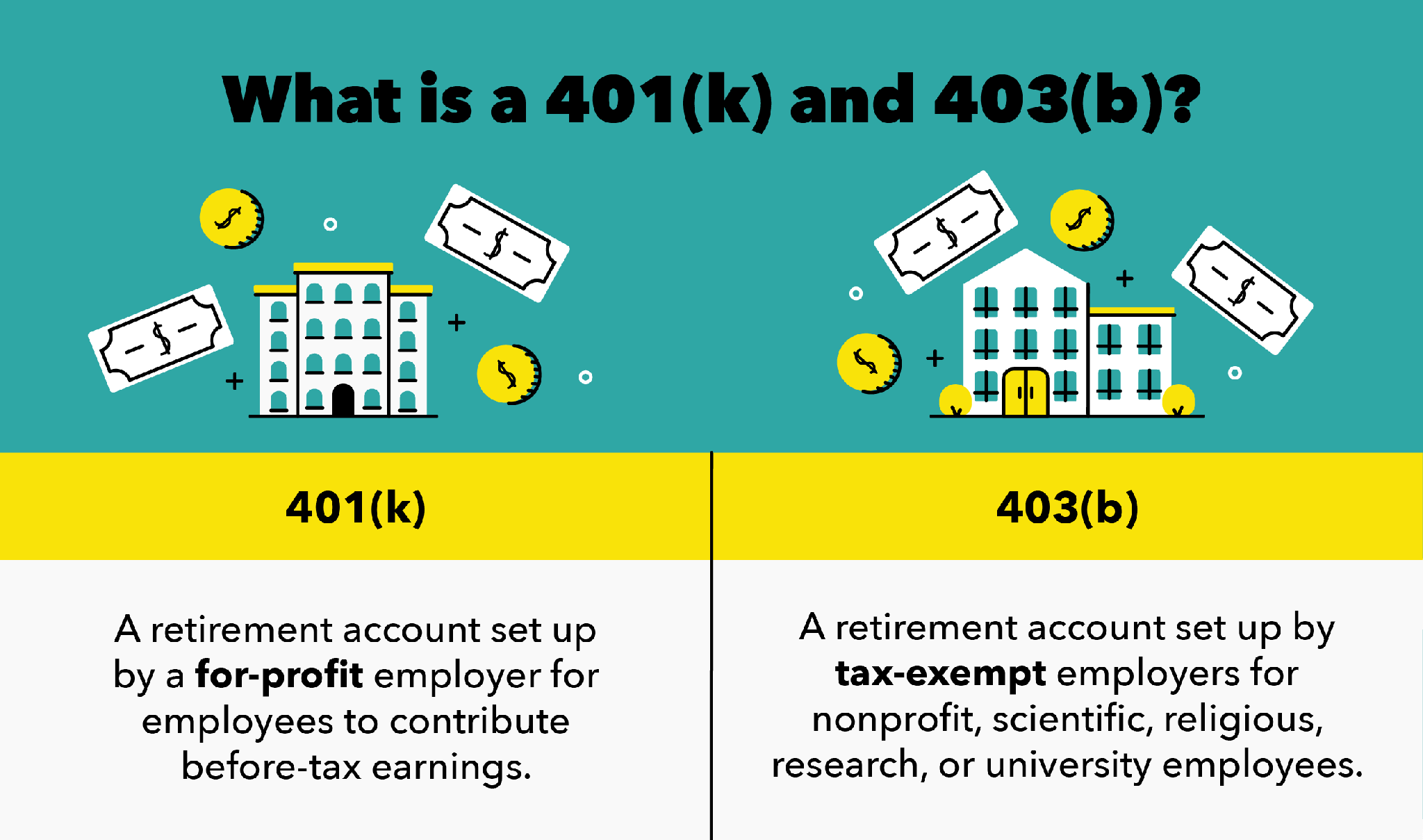

. Ad US Tax Treaty Countries nonresident aliens can take a tax free withdrawal. The difference between the plans makes the advantages of 401k and 401a plans more comprehensible. According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations.

Ad US Tax Treaty Countries nonresident aliens can take a tax free withdrawal. A 403 b plan is also another name for a tax-sheltered annuity plan and the features of a 403 b plan are comparable to those found in a 401 k plan. However a traditional 401k is already tax-sheltered and a delayed rollover could cost you in taxes.

Its similar to a 401 k plan maintained by a for-profit entity. By Retirement Advisor Aug 16 2022. An annuity can be jointly owned and can be purchased by anyone.

Draw US Retirement account should be pre tax planned utilizing tax savings strategies. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. However you contribute to annuities with after-tax dollars while you contribute to traditional 401ks with pre-tax dollars.

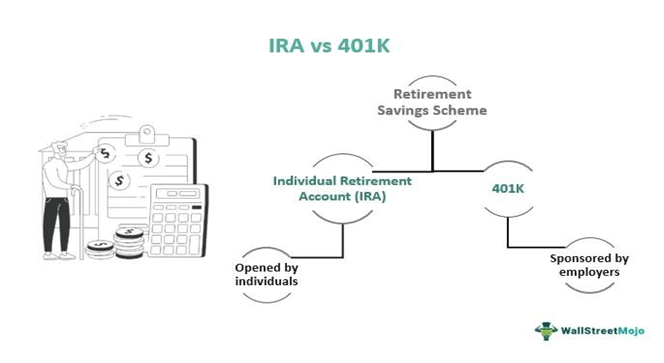

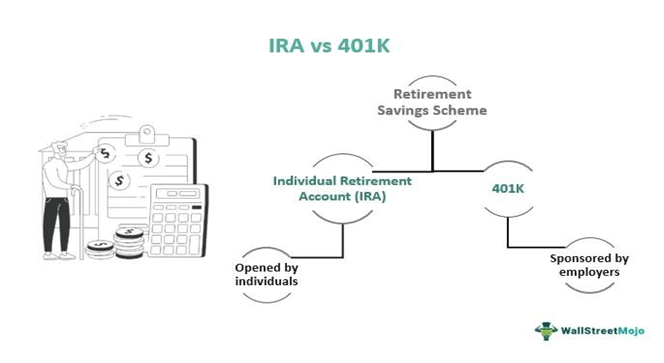

401 k plans are offered by for-profit companies to eligible employees who contribute pre or post-tax money through payroll deduction. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. How To Transfer Your 403b To Another Account.

Fixed and Variable Annuity are the two main types of Annuity. Ad Your comprehensive guide to 401k management for non-US residents is here. People use their 401 k to accumulate and hopefully grow their money for.

Draw US Retirement account should be pre tax planned utilizing tax savings strategies. 403 b plans are offered to. When its time to withdraw money in retirement you will.

Key Takeaways Annuities can come with a host of fees and charges that. TSAs on the other hand are only available to employees working for tax-exempt organizations and public schools colleges and universities. You will not owe income taxes on the investment returns of a 401k or annuity until you withdraw.

One can also opt for the 403 b plan for extra advantages after perusing. Both annuities and 401ks provide a tax-sheltered way to save for retirement. There are no types of 401k accounts.

Ad Your comprehensive guide to 401k management for non-US residents is here.

Difference Between 401k And 403b Difference Between

A 401 K Vs An Ira For A Sixty Year Old

Does An Annuity Belong In Your 401 K Smartasset

401k Distribution Request Form Fill Out Printable Pdf Forms Online

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Investing In 401 K Plan Vs Investing In Stocks Finance Strategists

Solo 401k Faqs My Solo 401k Financial

/156532699_Dimitri-Otis_DigitalVision_GettyImages_annuity-56a635ef5f9b58b7d0e06bc3.jpg)

What Are The Risks Of Rolling My 401 K Into An Annuity

What S The Difference Between 401 K And 403 B Retirement Plans

403 B Vs 401 K Comparison Pros Cons Examples

All The Difference Between 403b And 401k Plans You Should Know About Financial Digits

Stocks Part Viii The 401k 403b Tsp Ira Roth Buckets Jlcollinsnh

What Is A Tax Sheltered Annuity Due

Retirement Plans Pensions And Annuities

Ira Vs 401k Meanings Types Similarities Differences

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

Understanding Indexed Universal Life Insurance Vs Iras 401 K S

11 Evaluate Your 401k Or Ira Carefully When Planning For Medicaid